Policy Shift Raises Concerns About Competitiveness in Global Education Market

In a move that has sent ripples through Australia's vocational education and training sector, the Labor government has announced plans to increase international student visa application fees by 25 per cent, from $1600 to $2000, if re-elected. The proposed fee hike, scheduled to take effect from July 1, has sparked significant debate about Australia's competitive position in the global education market and the potential impact on vocational education providers that rely heavily on international enrolment.

Treasurer Jim Chalmers, announcing the measure during a press conference in Brisbane, framed the increase as "a sensible measure that really prizes the value of studying here in Australia." The government projects that the higher fees will generate approximately $760 million in additional revenue over the forward estimates, contributing to Labor's election funding commitments in other policy areas.

For Australia's VET sector, which has worked diligently to rebuild international enrolments following the COVID-19 pandemic, the announcement raises important questions about future growth, competitive positioning, and the sector's ability to continue attracting quality international students in an increasingly competitive global marketplace.

International Context: Australia's Growing Price Premium

The proposed fee increase would further extend Australia's already substantial price premium for student visas compared to other major international education destinations. At the current rate of $1600, Australia already maintains the highest student visa application fees among its primary competitors. By comparison, studying in the United States requires a visa application fee of approximately $306 (USD 185), Canada charges around $472 (CAD 150), New Zealand $695 (NZD 750), and the United Kingdom $1047 (GBP 490).

If implemented, the $2000 fee would position Australia at nearly four times the cost of its closest competitor, creating what some industry experts describe as a potential deterrent for price-sensitive students considering their global study options. This disparity becomes particularly significant for vocational education students, who typically enrol in shorter courses with lower overall tuition compared to university degrees, making visa costs a more substantial percentage of their total investment.

Phil Honeywood, Chief Executive of the International Education Association of Australia, expressed concern about this growing gap, noting that "there are major concerns about cost differentials with competitive countries such as the UK, Canada, the US and New Zealand." This view reflects broader industry anxiety that Australia risks positioning itself as a premium-priced destination without necessarily offering corresponding advantages that justify the higher costs. The education and training sector directly employs more than 100,000 Australians and delivers enormous cultural and diplomatic benefits to the nation.

The Coalition has proposed even steeper increases—$5000 for Group of Eight universities and $2500 for other institutions—as part of its plan to cap international enrolments at 230,000 annually. While Labor's proposed increase is more modest, it continues a trajectory of rising costs for international students seeking to study in Australia.

You can read the promises made by both political parties here

Australia's ruling party to hike student visa fees again in pre-election pledge | Reuters

And

Coalition to cut international student numbers by 80,000, raise visa application fees | SBS News

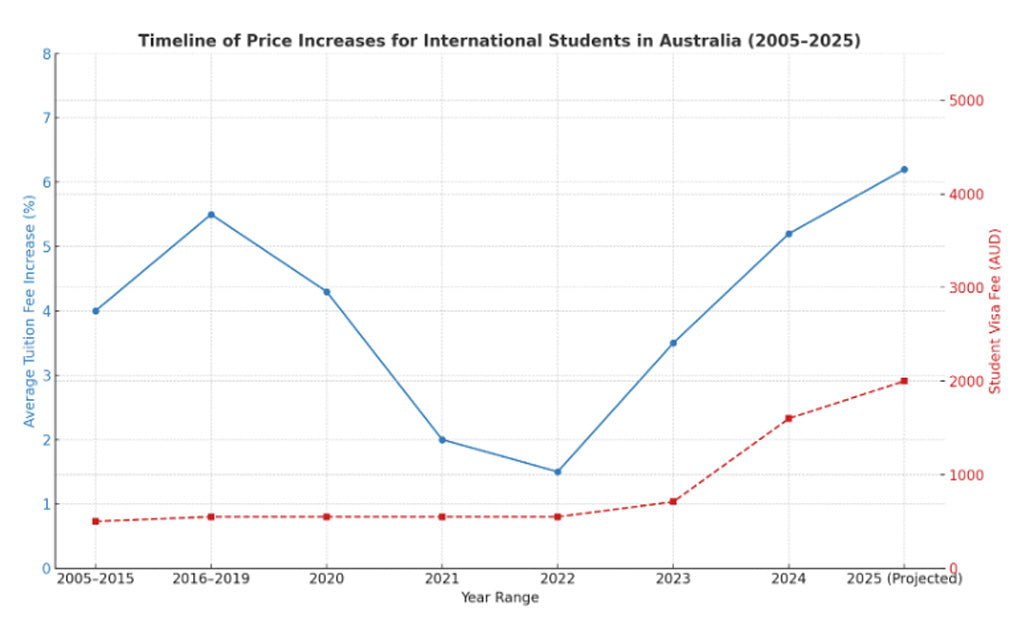

Timeline of Fee Increases for International Students in Australia2024–2025 has seen major changes in both visa application fees and tuition fees for international students in Australia. Below is a detailed timeline and summary of key developments: 1 July 2024: Major Student Visa Fee Increase

Late 2024–Early 2025: Tuition Fee Increases Across Universities

December 2024: Introduction of Ministerial Direction 111 (MD111)

April 2025: Announcements of Further Planned Visa Fee Hikes

Ongoing: Annual Tuition Fee Adjustments

|

Impact on Vocational Education Providers

X-Axis (Visa Fee AUD): Higher visa fees push countries further to the right.

Y-Axis (Application Drop Risk% ): Higher risk of application declines moves countries higher on the chart.

Bubble Size: Proportional to visa fee amounts, making Australia's burden visually dominant.

Colours and Annotations: Highlight key differences between Australia and other countries.

For Australia's VET sector, which has traditionally offered accessible pathways for international students seeking practical skills and qualifications, the visa fee increase presents particular challenges. Unlike universities, which typically charge higher tuition fees and attract students pursuing multi-year degrees, vocational education providers often compete on value, accessibility, and direct employment pathways.

"The VET sector operates with tighter margins and often serves students who are more price-sensitive than those entering prestigious universities," explains the director of international education at a major metropolitan RTO. "When you're offering a one-year certificate or diploma, a $2000 visa fee becomes a significant percentage of the overall study investment. This potentially changes the value equation for many prospective students."

Industry data suggests that international students contribute approximately $51 billion annually to the Australian economy, with the VET sector capturing a significant portion of this market, for more information, please visit the Australian Bureau of Statistics (ABS)’s website Recording of international students in the balance of payments | Australian Bureau of Statistics. Following pandemic-related disruptions, many training providers have invested heavily in rebuilding their international student programs, developing specialised support services, and establishing recruitment channels in key markets across Asia, South America, and, increasingly, Africa.

These investments now face potential headwinds as providers must explain rising cost structures to prospective students and education agents. Some smaller and regional providers fear they may be disproportionately affected, as they typically lack the brand recognition and premium positioning of major universities that can more easily absorb and justify higher costs.

Policy Complexity and Sectoral Implications

Beyond the immediate financial implications, Honeywood and others have expressed concern about growing policy complexity in Australia's international education framework. The recent exemption of Timor-Leste and the Pacific Islands from the $1600 visa fee (returning them to the 2023 fee of $710) creates a multi-tiered system that adds administrative complexity for providers.

For RTOs with diverse international cohorts, these policy variations create additional counselling requirements and potentially complicate marketing messages. "We're trying to provide clear, consistent information to prospective students, but the frequent policy changes make this increasingly difficult," explains Chen. "Every change requires updates to our marketing materials, training for our agents, and staff time spent explaining the implications to applicants."

Some in the sector also question whether visa fee increases represent an effective policy for addressing quality and integrity concerns in international education. Rizvi characterises the approach as "making policy on the run," arguing there is "zero evidence that raising visa fees will achieve" improvements in quality and integrity.

Education Minister Jason Clare has defended the increase, stating the fee "reflects the value of a quality Australian education and will help support integrity in the sector." However, the precise mechanisms by which higher fees would enhance educational quality or system integrity remain unclear to many sector participants.

Strategic Responses for VET Providers

As the sector digests the implications of another potential fee increase, forward-thinking RTOs are developing strategic responses to maintain their competitive position. These approaches include:

Enhanced value articulation, with greater emphasis on employment outcomes, migration pathways, and the quality of the Australian training experience. Many providers are strengthening their employer connections and developing more robust work-integrated learning programs to demonstrate concrete returns on student investment.

Diversified recruitment strategies that reduce reliance on price-sensitive markets and develop presence in regions where students prioritise quality and outcomes over initial costs. This includes a greater focus on specialised vocational programs where Australia maintains distinct competitive advantages.

Streamlined application processes are designed to minimise administrative barriers and create more seamless experiences for international applicants. Some providers are investing in technology platforms that simplify documentation requirements and reduce the time between application and enrollment.

Partnership models with offshore delivery partners that allow students to begin their studies in their home country before transitioning to Australia. These arrangements can reduce the overall cost of obtaining an Australian qualification while maintaining the benefits of Australian quality assurance.

Advocacy for policy coherence through industry bodies and direct government engagement. Many RTOs are actively participating in consultations and policy discussions, emphasising the need for stable, predictable regulatory frameworks that allow for sustainable business planning.

"The providers that will thrive despite these challenges are those that clearly articulate their value proposition beyond price," suggests Thompson. "International students are sophisticated consumers who consider multiple factors—from quality of training to employment prospects to lifestyle. RTOs need to excel across these dimensions to justify Australia's premium positioning."

Looking Ahead: Policy Stability and Sector Sustainability

As election campaigning continues, the international education sector—and particularly VET providers—are calling for greater policy stability and a more nuanced approach to international student management. Many sector leaders acknowledge the need for appropriate regulatory frameworks but emphasise that frequent, significant changes undermine Australia's reputation as a reliable, welcoming destination for quality education.

The proposed visa fee increase represents just one element of Australia's evolving approach to international education. Both major parties have signalled intentions to cap international student numbers, with Labor proposing a limit of 270,000 commencements in 2025 compared to the Coalition's more restrictive 240,000 cap. These measures, combined with tightened English language requirements implemented last year, reflect growing political sensitivity around migration levels and housing pressures.

For Australia's vocational education sector, navigating this changing landscape requires both tactical responses to specific policy changes and strategic positioning for long-term sustainability. The sector's ability to continue delivering quality training to international students—and capturing the economic and cultural benefits they bring—will depend on adaptability, clear value articulation, and ongoing engagement with policy development.

As one RTO director summarises, "International education has always been dynamic, with constant adaptation required. The proposed visa fee increase is another change we'll need to accommodate. The key is maintaining our focus on quality, integrity, and student outcomes—these fundamental strengths will sustain Australia's appeal regardless of incremental cost increases."

While the full impact of the proposed fee increase remains to be seen, Australia's VET sector continues to demonstrate the resilience and adaptability that have characterised its approach to international education for decades. As policy evolves and global competition intensifies, this adaptability will remain the sector's most valuable asset in maintaining Australia's position as a leading destination for quality vocational education and training.